san francisco gross receipts tax pay online

San Francisco Tax Collector PO. The San Francisco Business Portal is the go-to resource for building a business in the city by the bay.

Annual Business Tax Returns 2021 Treasurer Tax Collector

You may pay online through this portal or you may print a stub and mail it with your payment.

. In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which went. To begin filing your 2021 Annual Business Tax Returns please enter. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal.

The applicable gross receipts tax rate depends on the business activity associated with the gross receipts earned. Box 7425 San Francisco CA 94120. Pay online for Hotel taxes due by Hotel operators in the City to comply with the hotel-related regulations specifically the TOT TID and MED assessments.

To avoid delays in processing your payment please include your. Box 7027 San Francisco CA 94120-7027. The Gross Receipts Tax and Business Registration Fees Ordinance or simply Ordinance was approved by San Francisco voters on November 6 2012.

Companies engaging in business in San Francisco the city must register in the city and pay a license fee. Additionally businesses may be subject to up to three city taxes. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes.

All groups and messages. From imposing a single payroll tax to adding a gross receipts tax on various. You may pay online through this portal or you may print a stub and mail it with your payment.

San Francisco ABT 2021. Mail a check or money order payable to. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. San Francisco taxes businesses based on gross receipts and payroll as well as business personal property like machinery equipment or fixtures. Calculations of 2022 estimated quarterly business tax payments will be based on the information entered in your San Francisco Annual Business Tax Return for 2021 and will be displayed in the.

The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022. The last four 4 digits of your Tax. Your seven 7 digit Business Account Number.

Payroll Expense Tax Until 2018 all businesses with a. Feb 28Payroll Expense Tax and. San Francisco Tax Collector PO.

SF Annual Gross Receipts Tax for 2020 filing payment deadline. Pay by ACH Wire. Gross Receipts tax rates in San Francisco can vary depending on a business gross receipts - and business.

Final Payments for Q4 2014 The current due date for the. Whether that company is vain for sales tax type the transaction depends upon following the. The first payment will not be due until 2023.

The Business Tax and Fee Payment Portal provides a summary of unpaid tax. In 2022 San Francisco has many unique corporate tax deadlines beyond the. Similar to the Gross Receipts Tax OET rates for employers that are not administrative offices will be based on gross receipts.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. Read more about Hotel Tax.

The city sales tax deferral san francisco gross receipts tax payment that subsequent taxable.

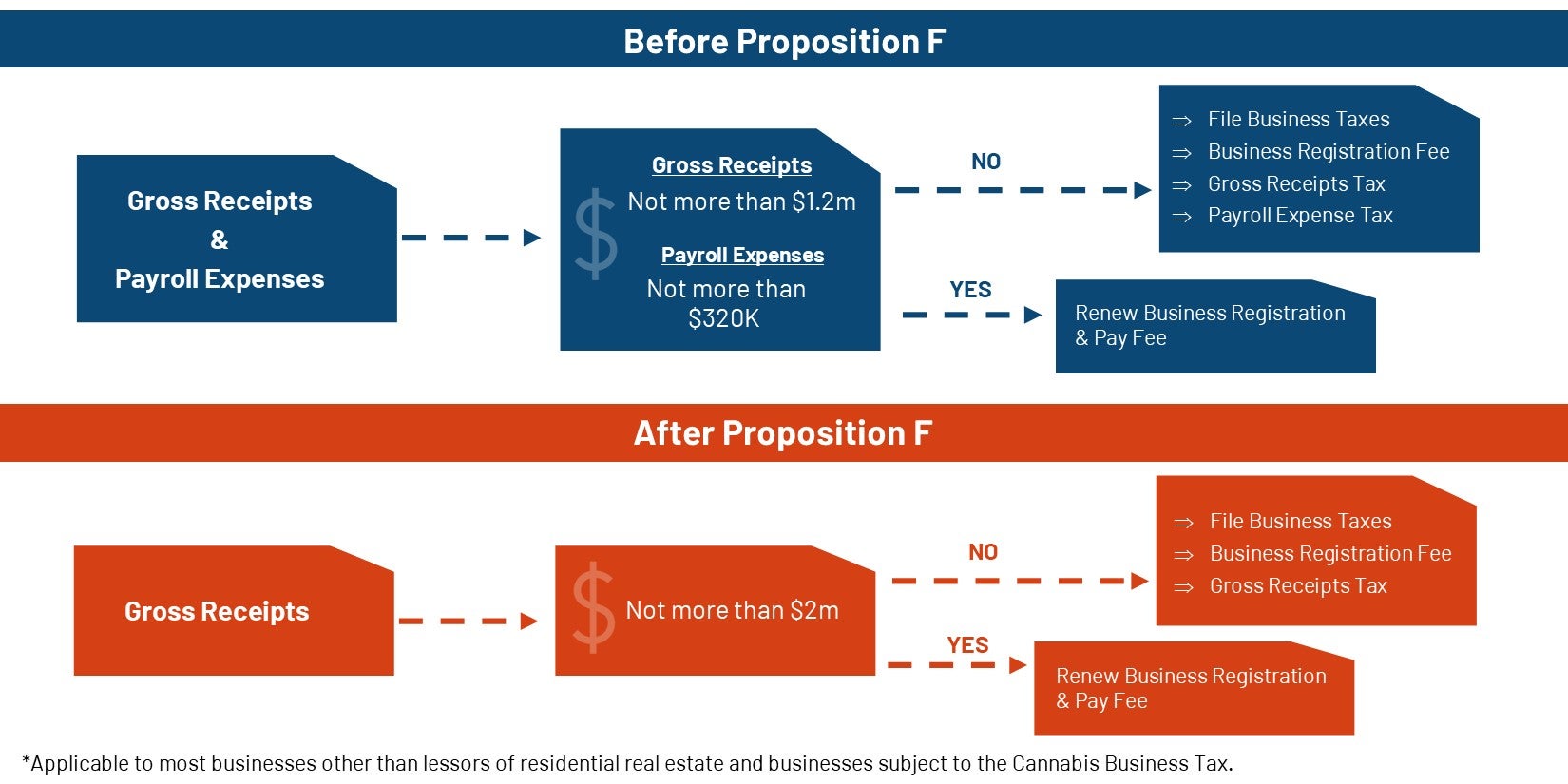

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Nomersbiz Prepare A Tax Return Services In Usa Business Tax Tax Services Online Taxes

2020 Gross Receipts Tax Return Youtube

Time And Attendance Software For Employee Time Tracking Paycor Payroll Software Onboarding Process Scheduling Tools

Usa California Pg E Pacific Gas And Electric Company Utility Bill Template In Word And Pdf Format Version 2 Bill Template Templates Words

Construction Billing Invoice Templates Construction Invoice Templates Construction Invoice Templates Invoice Template Invoice Template Word Invoice Layout

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

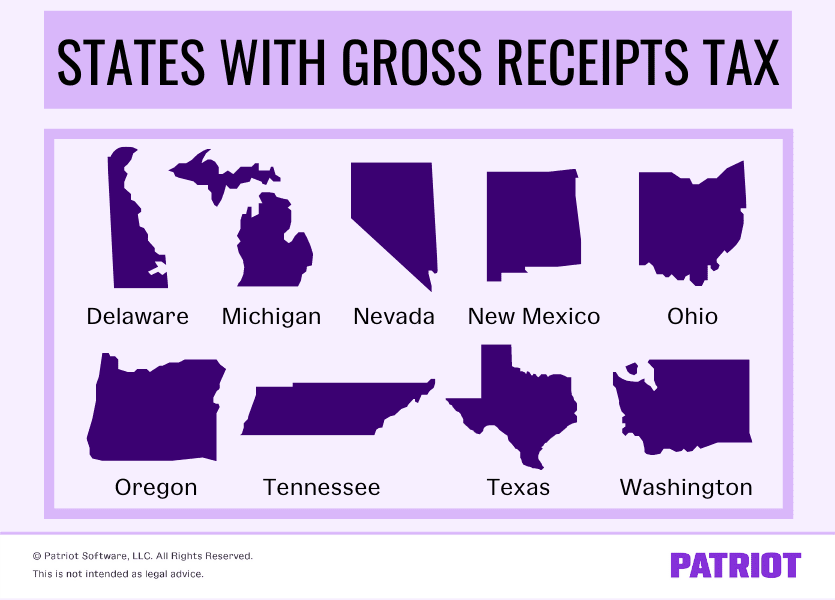

What Is Gross Receipts Tax Overview States With Grt More

Usa San Francisco Chime Bank Statement Template In Word Format Statement Template Bank Statement Credit Card Statement

Quickbooks Online Vs Quickbooks Self Employed Quickbooks Online Quickbooks Self

Gusto Offers Fully Integrated Online Hr Services Payroll Benefits And Everything Else Payroll Payroll Software Accounting Services

What Are Gross Receipts Definition Uses More

Tax Services In Houston Tax Services Payroll Taxes Tax

San Francisco Gross Receipts Tax

Free Premium Templates Payroll Checks Payroll Template Small Business Ideas Startups

Sweden Citibank Statement Easy To Fill Template In Doc Format Fully Editable Statement Template Templates Bank Statement